open end loan secu

SECU Mortgage Loan Officer-Closed opening hours. Choose a way to apply for your Open-End Signature Personal Loan.

Digital Credit Union No Credit Check Loan Open To Everybody Easy Soft Pull Membership Youtube

3 Apply Now Loan Specifications.

. Legal Accessibility Español Site Map Equal Housing Opportunity NMLS430055 Federally Insured by NCUA Skip To Content Open in the SECU Mobile App Sign In. Not a member of LGFCU yet. And you can borrow up to 90 of the value of your home without being charged any origination fees or discount points however processing fees up to 1600 may be applied.

Opens in 1 day. Call us at 8887328562. Securities lending is a well-established practice by institutional investors such as US.

Updated on April 9 2021 1 443-805-5171. With state-of-the-art financial centers all throughout Maryland 50000 free ATMS and a full range of banking services there are so many reasons to love SECU. APR is your cost over the loan term expressed as a rate.

Transfers from these types of protecting. Up to 6 Months. Opens in 1 day.

Variable rates subject to. APR is your cost over the loan term expressed as a rate. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments coming due.

3 Stated APR based on a loan amount of 150000 for a maximum term allowed for each loan. An open-ended loan in securities lending is a loan where there is no agreed upon end date. Overdraft transfers from SECU Visa credit card accounts open-end signature loans and home equity lines of credit are loan advances and may be made up to the amount of the available ceilingcredit limit less any outstanding principal balance.

SECU Mortgage Loan Officer-Closed opening hours. Future interest rate changes will be determined based on the 5-year Constant Maturity Treasury CMT yield. Updated on April 9 2021.

The amount available to borrow may also be. It is a secured open-end variable rate loan that allows you to borrow against your home equity. This loan plan provides you with an approved line of credit.

Open-end and closed-end investment companies funds insurance companies pension plans and college endowments. Predictable affordable payments that wont change for the life of your loan. Legal Accessibility.

Visit your local branch. Open-End Signature Loans With unlimited access to your credit line through real-time loan advances 1 our variable-rate 2 Open-End Signature loan is one of our most flexible finance options. 1 payment of 103205 at 65 for 100000 borrowed.

You can receive advances repeatedly over a 15-year draw period up to the maximum loan amount. Open-end credit also is referred to as. A fund whose investment objectives policies and restrictions permit it to engage in.

In an open-end mortgage the borrower can receive the loan principal at any time specified in the terms of the loan. APR Annual Percentage Rate. This is the most common form of securities lending arrangement making up 83 of loans according to the International Securities Lending Association ISLA the leading industry association for.

1075 APR 45 for new originations. APR Annual Percentage Rate. Termination only occurs when either you recall your securities or the borrower returns them.

These hours might be affected. Open-End and Closed-End Investment Companies. In other words the borrower has the right to tap into the credit made available to.

Credit Cards and Lines of Credit. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments coming due. Minimum payment based on the outstanding principal balance.

SECU Mortgage Loan Officer-Closed. Transfer funds from your SECU checking account to your loan account using Online Banking 24. 4 Rate cannot change by more than 2 every 5 years or 6 over the life of the loan.

An open end loan also known as a line of credit or a revolving line of credit is a type of loan where the bank offers credit to the borrower up to a certain limit and giving the borrower the freedom to use the amount of credit it needs whenever it is needed. An open-ended loan is an extension of credit where money can be borrowed when you need. Log in to Member Connect.

Becoming a member is easier than you think. Loans of 300 to 30000. APR Based on Salary Advance Cash Account Balance.

Open in the SECU Mobile App Sign In. Whether you use your loan to buy new furniture finance a home improvement or take the vacation of your dreams approved Members will enjoy. A variety of loan terms to make monthly payments manageable.

State Employees Credit Union Reviews 125 User Ratings

State Employees Credit Union Tax Refund Information

Visa Credit Cards Secu Credit Union

State Employees Credit Union Brochure

State Employees Credit Union Visa Credit Cards

Secu Suggests Ben Bernanke Consider A Credit Union

Term Loans Business Secu Credit Union

State Employees Credit Union Debit Cards

State Employees Credit Union Mobile App

Term Loans Business Secu Credit Union

State Employees Credit Union Secu Fast Auto Loan

Get 3 Credit Lines With Only 1 Inquiry Better Than Navy Federal Youtube

Secu Suggests Ben Bernanke Consider A Credit Union

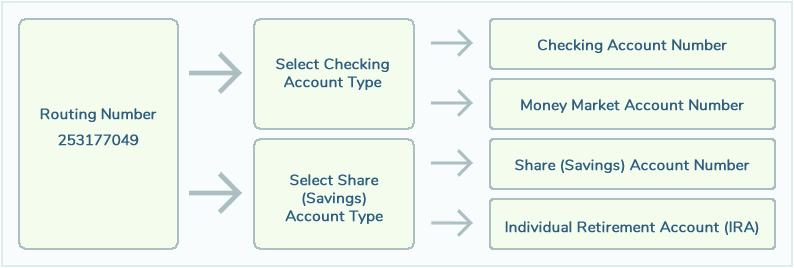

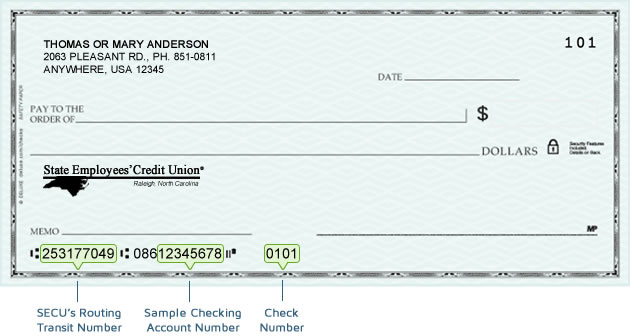

State Employees Credit Union Aba Routing Transit Number

Hidden Gem Secu Easy Approvals High Limits The New Navy Federal Credit Union Youtube

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)