is actblue donation tax deductible

If you volunteer give cash or non-cash items to a 501 c 3 organization your donation may be a qualified tax-deductible charitable contribution. Yet what shows up on reports looking like interest group dollars is.

Smart Recurring Actblue Support

Americans for Financial Reform engages in legislative advocacy and these donations are not tax deductible as a charitable contribution.

. But even though less than half 48 percent came from outside Texas. As a service it charges a transaction fee of 395 for each donation it receives and passes along to the final recipient. The Tax Cuts and Jobs Act of 2017 increased the charitable contribution deduction limit for cash gifts from 50 to 60 of adjusted gross income AGI.

Most of the 45 million in individual contributions ORourke raised through ActBlue came from Texas donors 52 percent. The main ACLU is a 501 c 4 which means donations made to it are not tax deductiblethough. Duplicated download links may be due to resubmissions or amendments to an organizations.

By contrast there is a 200 threshold for reporting individuals who contribute directly to a candidate committee. While you may think of the ACLU as one giant nonprofit the IRS does not. Yes count me in.

Your contribution will benefit Americans for Financial Reform. 15 25 50 100 250 500 1000 Make it monthly. ActBlue Charities is a qualified 501 c 3 tax-exempt organization and donations are tax-deductible to.

Organizations are searchable by legal name or a doing business as name on file with the IRS. Typically deductible charitable contributions are those made to organizations that are tax-exempt under 501c3 of the Internal Revenue Code. Form 8283 Noncash Charitable Contributions Taxpayers must file Form 8283 to report noncash charitable contributions if the amount of this deduction is more than 500.

Except that for 2020 you can deduct up to 300 per tax return of qualified cash contributions if you take the standard deduction. For some candidates ActBlue accounts for 20 percent or more of money raised. To claim tax deductible donations.

Additionally capital losses are a tax deduction. For 2021 this amount is up to 600 per tax return for those filing married filing jointly and 300 for other filing statuses. No donate once Checkout Have an ActBlue Express account.

Donors can use it to confirm that an organization is tax-exempt and eligible to receive tax-deductible charitable contributions. Depending on how you donate your gift may or may not be tax deductible. At the bottom of the page it clearly states.

Contributions or gifts to ActBlue are not deductible as charitable contributions for. The ACLU actually has two arms the lobbying organization and the foundationand particularly if you itemize your taxes it pays to be aware of the difference. Washington state officials notified BLM in a Jan.

According to the National Philanthropic Trust Americans gave 4714 billion to charities in 2020 an increase of 51 over 2019 and proof that in good times and bad the. Read the IRS instructions for 990 forms. Taxpayers generally can deduct the fair market value of property they donate.

Fundraising ActBlue raised 19 million in. Tax deductible donations are contributions of money or goods to a tax-exempt organization such as a charity. Registered charities list of charities registered journalism organizations RJO registered Canadian amateur athletic associations registered national arts service organizations.

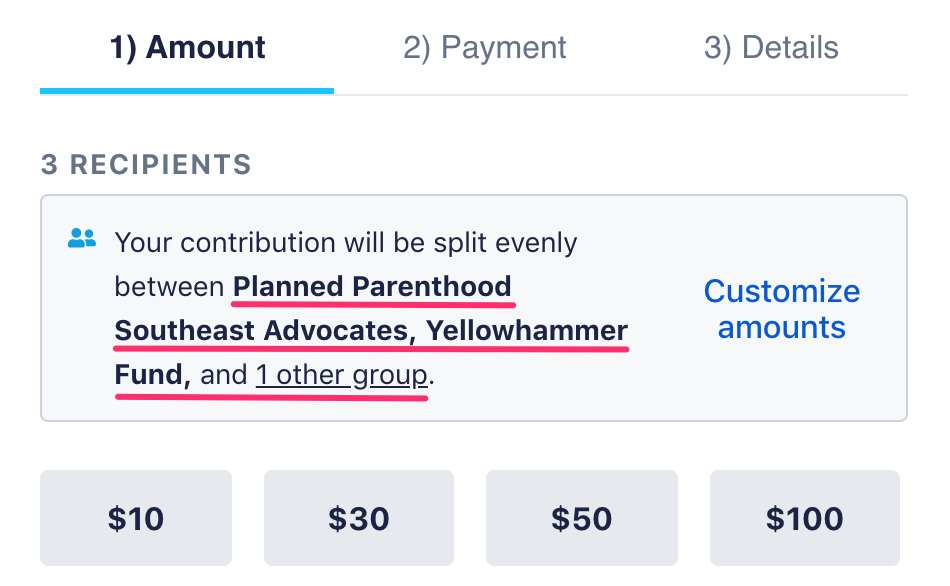

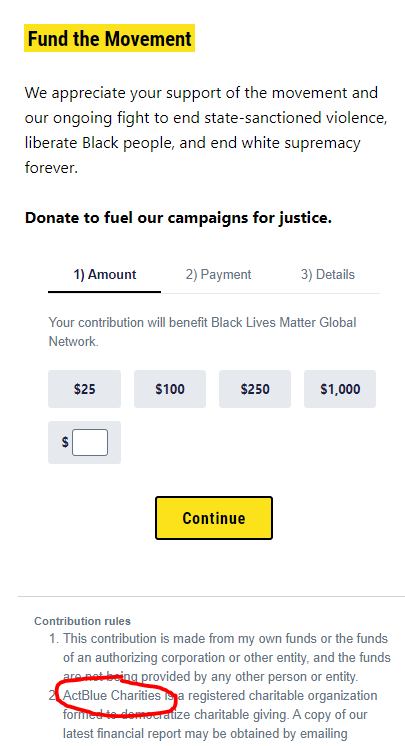

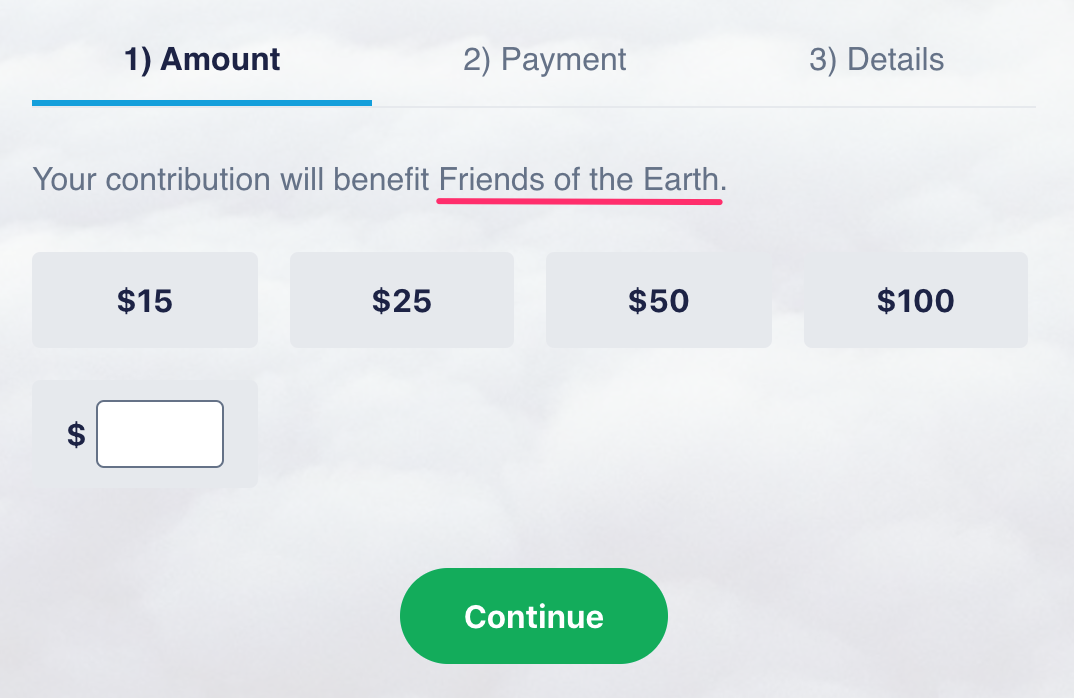

When you donate on an ActBlue or ActBlue Charities page the donation is earmarked for the group listed on the form Caleb Cade a spokesperson for ActBlue told us in an email. 2402 Philadelphia PA 19107 VoteAmerica is a nonpartisan nonprofit organization. By proceeding with this transaction you agree to ActBlues terms conditions.

You can claim a tax credit based on the eligible amount of your gift to a qualified donee. This type of organization is specifically barred from attempting to. Donations to qualifying charity organizations are deductible on your tax return and may reduce your taxable income and overall tax bill as long as you follow IRS guidelines.

For 2020 the AGI limits have been temporarily. When you sell an investment or lose money on bad debt portions of those deficits might be tax-deductible. Users can find out if an organization had its tax-exempt status revoked.

Donations are processed by Actblue Charities and are tax-deductible. 5 letter that the charity faces fines upwards of 2000 for each donation it solicits. 6 17 45 90 150 250 500 Make it monthly.

Although political contributions are not tax-deductible other deductions can help both individuals and businesses save money on taxes. 1213 Walnut Street Apt. The ACLU Foundation is a 501 c 3 nonprofit which means donations made to it are tax deductible.

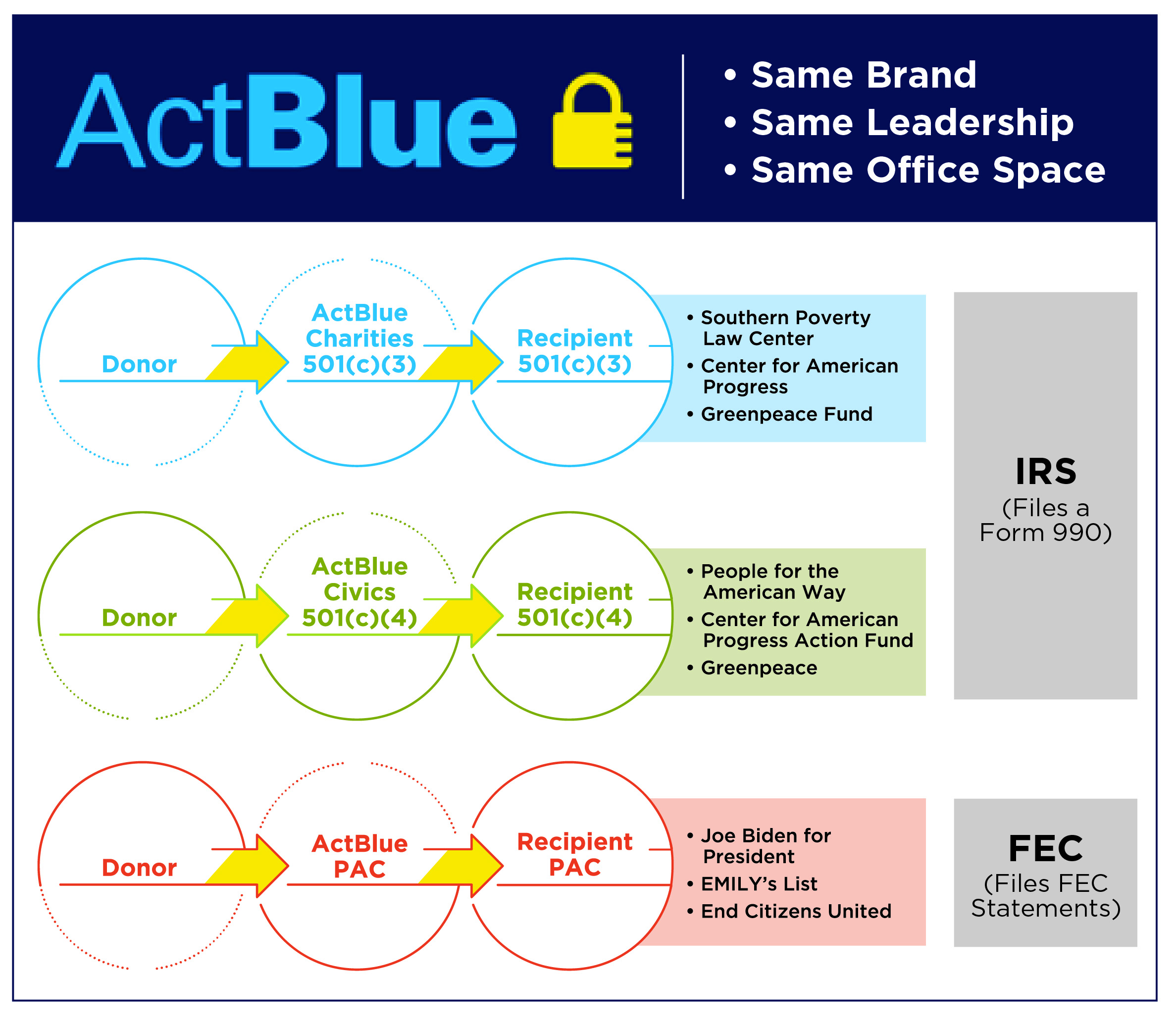

If this organization has filed an amended return it may not be reflected in the data below. Contributions or gifts to ActBlue are not deductible as charitable contributions for Federal income tax purposes. You can confirm whether the organization you are going to make a donation to is a 501 c 3 organization using the Tax-Exempt Organization Search Tool from the IRS.

She was immediately redirected to ActBlue which is the activist arm of the Democrat Party. Typically youll list any charitable donation deductions on Form 1040 Schedule A. Tax Filings by Year.

Many small donors whose names would ordinarily be shielded are thus exposed to the public. Your contribution will benefit VoteAmerica. ActBlue Charities is ActBlues funding platform built specifically for 501 c 3 organizations which can receive tax-deductible contributions.

The IRS Form 990 is an annual information return that most organizations claiming federal tax-exempt status must file yearly. Yes count me in. Tax deductible donations can reduce taxable income.

Just the word donation can be misleading because only some contributions or donations are actually tax deductible. This publication helps determine the value of donated property.

How Can I Look Up My Contribution Actblue Support

How Do I Know Who My Donation Is Going To Actblue Support

Are My Donations Tax Deductible Actblue Support

I Don T Remember Adding A Tip To My Contribution Actblue Support

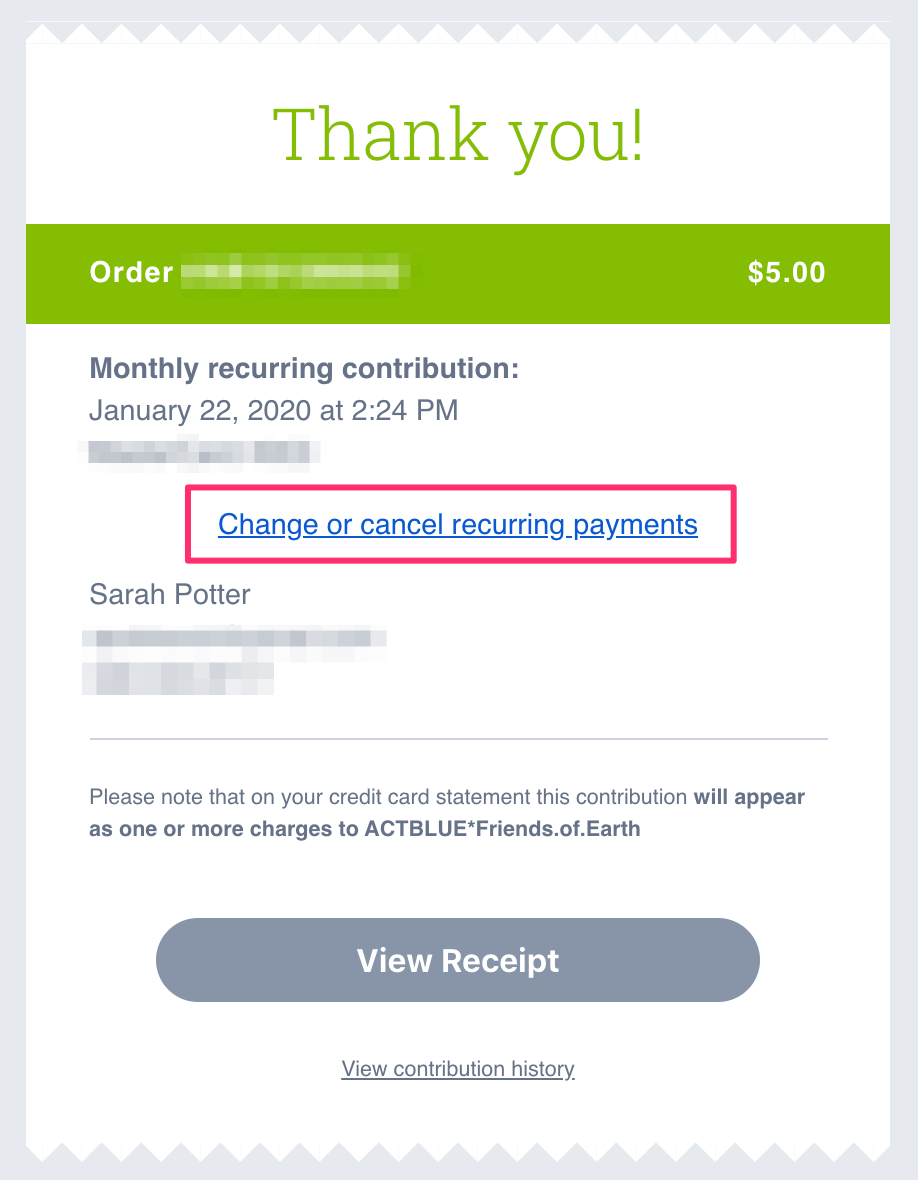

I Didn T Mean To Make A Recurring Donation What Do I Do Actblue Support

Actblue The Left S Favorite Dark Money Machine Capital Research Center

What Happens To My Money When I Donate Actblue Support

I Don T Remember Adding A Tip To My Contribution Actblue Support

How Do I Change The Email Address My Receipts Are Sent To Actblue Support

Why Don T I See My Donation History When I Log Into My Account Actblue Support

Actblue The Left S Favorite Dark Money Machine Capital Research Center

I Don T Remember Adding A Tip To My Contribution Actblue Support

How Do I Update My Information For Recurring Contributions Actblue Support

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

Why Is There A Disclaimer Box At The Bottom Of The Contribution Form Actblue Support